MACRA – Physician Payment Reform

What is MACRA?

- On April 16, 2015 President Obama signed into law the Medicare Access and CHIP Reauthorization Act of 2015.

- MACRA is changing the healthcare reimbursement system in the most significant and far reaching way since the program’s inception in 1965.

- MACRA repealed the flawed Sustainable Growth Rate (SGR) payment system that governed how physicians and other clinicians were paid under

- The fee-for-service reimbursement model is being replaced the Quality Payment Program, a new two-track system: Merit-Based Incentive Payment System (MIPS) and/or Advanced Alternative Payment Models (APMs).

- The Quality Payment Program performance period begins in 2017.

- Providers will see revenue impacted by 2019.

Merit – Based Incentive Payment System (MIPS)

Portion of practice Medicare revenue at risk at tax ID or individual levels based on performance in these categories:

| Measure Category | Year 1 (2019) | Year 2 (2020) | Year 3 (2021) |

| Quality ( aka PQRS) | 60% | 45% | 30% |

| Cost – Resource Use (aka VM) | 0% | 15% | 30% |

| Advancing Care Information (aka MU) | 25% | 25% | 25% |

| Improvement Activities (IA – New) | 15% | 15% | 15% |

Advanced Alternative Payment Models (APM)

No downside risk on Part B fee schedule if thresholds are achieved through an ‘Advanced’ APM:

| *Thresholds2019 | 2019-2020 | 2021-2022 | 2023+ |

| % Payments | 25% | 50% | 75% |

| % Patients | 20% | 35% | 50% |

Initial Advanced APMs:

- Comprehensive Primary Care Plus (CPC+)

- MSSP Tracks 2 & 3 and Next Gen ACO

- Oncology Care Model Two-Sided Risk

- Comprehensive ESRD Care Model (CEC)

- Comprehensive Joint Replacement (CJR)

MACRA will have a profound effect on the entire health care continuum. From solo practitioners to large health systems, this overhaul of the Part B payment system has significant implications:

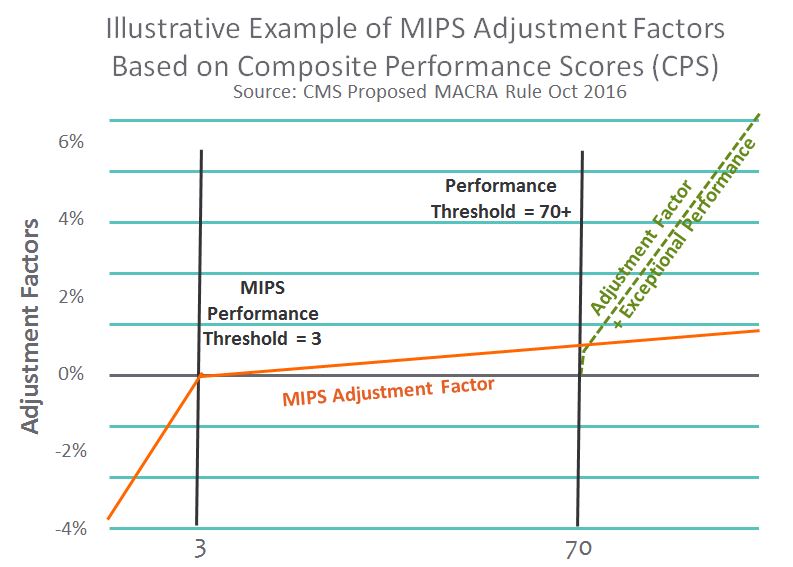

- From 2019 on, providers will not be paid the same for services provided to Medicare patients (ranging from 91% to +127% or more of Medicare).

- Performance in MIPS categories will be publicly available on Physician Compare.

- Providers transitioning to Advanced APMs will minimize downside risk and receive a +5% annual lump sum bonus (2019 – 2024).

- Medicare Physician Fee Schedule differential of .5% between MIPS and Advanced APM providers from 2026 forward.

There is a lot to do to prepare for the first performance period which begins January 2017. Here’s how we can help:

MACRA Readiness Assessment

MACRA’s performance period started January 2017. Do you have a plan?

Save Precious Time

With 2,400 pages in the law, 300+ measures, 4 categories and 3 paths, MACRA is daunting. The assessment will help your practice understand the path you’re headed for, revenue projections and recommended steps to take in the coming months.

Loaded with Value

The assessment combines practice-specific information education session packed with consultative guidance. You’ll leave with clear steps and recommendations. Join us to ensure your organization makes informed, sustainable decisions.

How it Works

You provide information in advance. We analyze it. We teach you MACRA. We lead you through your MACRA Readiness Assessment. You receive a practice-specific MACRA Workbook packed with what you’ll need to succeed.

Key Deliverables:Customized MACRA Action Plan for your practice

Practice Specific QRUR (Cost) Analyses

Practice Specific Quality & IA Recommendations

Personalized MACRA Economic Impact Study

Specific AAPM activity in your geography

Unparalleled MACRA education – easy to understand and ready to implement

MACRA toolkit – packed with resources

We are skilled at taking today’s data (QRUR, PQRS, MU) and using it as a guide for creating your customized MACRA roadmap. A MACRA Readiness Assessment provides comprehensive MACRA education, your QRUR analysis, and recommended measures for consideration in reporting in year one of Medicare’s Quality Payment Program. The assessment includes customized, recommended steps for you to take in the coming months. Our goal is to prepare you to be successful under MACRA and maximize your opportunities based on your strengths, capabilities and vision for the future.

MACRA Readiness Workshop

For groups, we can facilitate a “MACRA Readiness Workshop” providing a working session designed to assist your members in gaining insights and identify key questions to prepare for success in the Quality Payment Program. We recently facilitated this event at the CIP17 Collaborate conference hosted by the MGMA and AMA.

Here’s what participants had to say:

“They made it so simple and gave us a toolkit that saved us tons of time.”

“The ‘MACRA Readiness Assessment’ is the must have MACRA cliffnotes.”

“Incredible content, thought provoking and great guidance.”

“This was the 5th MACRA presentation I had been to this year, and it was by far the most clear and comprehensive.”